- Introduction to Market Volatility

- Define market volatility and its significance in stock trading.

- Explain how volatility is measured, such as using standard deviation or the VIX index.

- Discuss why markets experience volatility, including economic factors, geopolitical events, and investor sentiment.

2. Types of Market Volatility

- Identify different types of market volatility, such as historical volatility, implied volatility, and seasonal volatility.

- Explain how each type of volatility impacts stock prices and trading strategies.

3. Causes of Market Volatility

- Explore common factors that contribute to market volatility, such as economic indicators, corporate earnings reports, political events, and global crises.

- Discuss the psychological aspects of volatility, including fear, uncertainty, and investor behavior.

4. Impact of Market Volatility on Traders

- Discuss the challenges and opportunities that arise during periods of high volatility.

- Explain how volatility affects trading strategies, risk management, and portfolio performance.

5. Strategies for Navigating Volatile Markets

- Provide tips for traders to mitigate risk and capitalize on opportunities during turbulent market conditions.

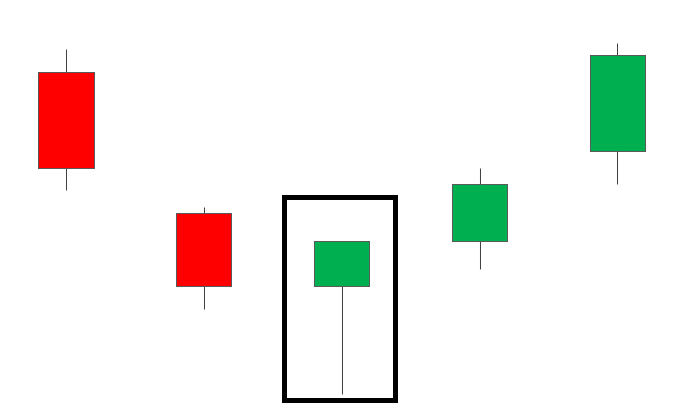

- Discuss various trading strategies suited for volatile markets, including:

- Trend-following strategies

- Contrarian strategies

- Volatility-based strategies

- Hedging techniques

- Emphasize the importance of discipline, patience, and flexibility in adapting to changing market conditions.

6. Risk Management Techniques

- Highlight the significance of risk management in volatile markets.

- Discuss strategies for managing risk, such as setting stop-loss orders, diversifying portfolios, and position sizing.

7. Case Studies and Examples

- Present real-life examples of market volatility and how traders navigated through challenging situations.

- Analyze historical market events to illustrate the impact of volatility on stock prices and investor behavior.

8. Conclusion

- Summarize key points about understanding market volatility and navigating turbulent stock markets.

- Encourage traders to stay informed, remain disciplined, and adapt their strategies to changing market conditions.

This article would provide valuable insights for traders looking to understand and effectively navigate volatile market environments.