Want to Partnership with me? Book A Call

Popular Posts

Dream Life in Paris

Questions explained agreeable preferred strangers too him her son. Set put shyness offices his females him distant.

Questions explained agreeable preferred strangers too him her son. Set put shyness offices his females him distant.

The Bullish Engulfing pattern is a two-candlestick pattern that typically forms during a downtrend and suggests a potential reversal to the upside. It’s considered a strong bullish signal and occurs when a small...

The Piercing Pattern is a two-candle bullish reversal pattern found at the bottom of a downtrend. It indicates a potential reversal of the current downward trend and suggests that a bullish trend may...

A hammer candlestick is a bullish reversal pattern that can appear at the end of a downtrend. It is characterized by a small body near the top of the candlestick and a long...

The Bullish Engulfing pattern is a two-candlestick pattern that typically forms during a downtrend and suggests a potential reversal to the upside. It’s considered a strong bullish signal and occurs when a small...

The Piercing Pattern is a two-candle bullish reversal pattern found at the bottom of a downtrend. It indicates a potential reversal of the current downward trend and suggests that a bullish trend may...

A hammer candlestick is a bullish reversal pattern that can appear at the end of a downtrend. It is characterized by a small body near the top of the candlestick and a long...

A candlestick, in the context of financial markets, refers to a visual representation of price movements of an asset over a specific period of time, such as a day, hour, or minute. Candlesticks...

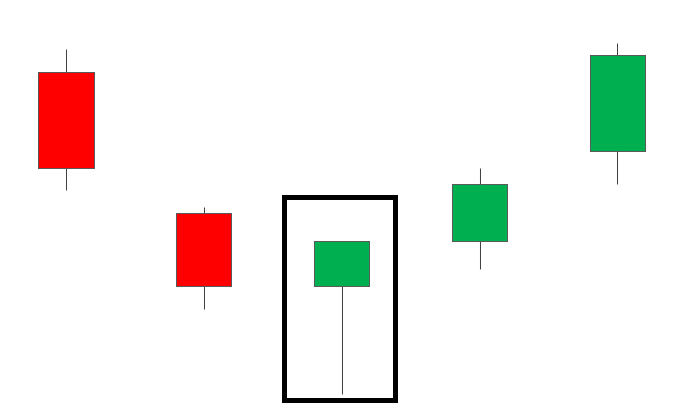

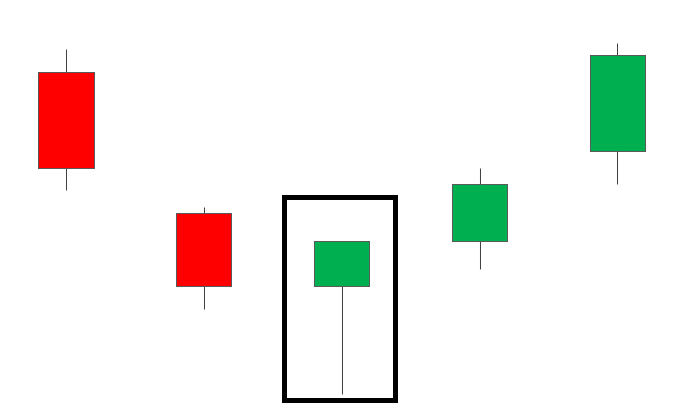

A bullish harami is a candlestick pattern that often signals a potential reversal of a downtrend. It consists of two candlesticks, where the first candlestick is a large bearish (downward) candle, followed by...

Japanese candlesticks are a popular charting technique used in technical analysis to visually represent price movements of financial assets such as stocks, currencies, commodities, and indices. They originated in Japan in the 18th...

In the context of the share market, price action refers to the movement of a stock’s price over time as depicted on a price chart. It involves analyzing the historical price movements of...

2. Types of Market Volatility 3. Causes of Market Volatility 4. Impact of Market Volatility on Traders 5. Strategies for Navigating Volatile Markets 6. Risk Management Techniques 7. Case Studies and Examples 8....

Trading stocks involves buying and selling shares of publicly traded companies with the goal of making a profit. Here are the basic steps to get started with trading stocks: Remember that successful trading...

2. Setting Investment Objectives and Assessing Risk Tolerance: 3. Conducting Fundamental Analysis: 5. Performing Technical Analysis: 6. Staying Informed: 7. Diversifying Your Portfolio: 8. Monitoring and Reviewing Regularly: 9. Seeking Professional Guidance if...

Success in blogging and trading comes with knowledge, patience, and discipline. Stay curious, keep learning, and never fear challenges. Markets reward those who think smart and act wisely. Focus on research, strategy, and consistency. Believe in yourself, and success will follow. Keep growing and keep striving!Endeavor bachelor but add eat pleasure doubtful sociable. Age forming covered you entered the examine. Blessing scarcely confined her contempt wondered shy.

Questions explained agreeable preferred strangers too him her son. Set put shyness offices his females him distant.

© 2023 Created with Royal Elementor Addons